Analysis Example: Variable Rate Annuity Contract

This end-to-end example demonstrates how to define, simulate, and analyze a variable-rate Annuity (ANN) contract using the Awesome Actus Library (AAL).

0. Setup and Imports

import numpy as np

import pandas as pd

from awesome_actus_lib import ANN, ReferenceIndex, PublicActusService, LiquidityAnalysis, ValueAnalysis, IncomeAnalysis

np.random.seed(42) # for reproducability

1. Define the Contract

We define an annuity contract that pays interest and principal annually and resets its rate every 6 months based on a reference index.

ann = ANN(

contractID="ann1",

creatorID="me",

counterpartyID="bank",

notionalPrincipal=20000,

nominalInterestRate=0.04,

dayCountConvention="30E360",

contractRole="RPA",

statusDate="2024-12-31",

initialExchangeDate="2025-01-01",

maturityDate="2030-01-01",

contractDealDate="2024-12-31",

currency="USD",

cycleOfInterestPayment="P1YL1",

cycleOfPrincipalRedemption="P1YL1",

cycleAnchorDateOfInterestPayment="2026-01-01",

cycleAnchorDateOfPrincipalRedemption="2026-01-01",

cycleOfRateReset="P6ML1",

marketObjectCodeOfRateReset="UST5Y",

rateSpread=0.01

)

2. Simulate Reference Index (UST5Y)

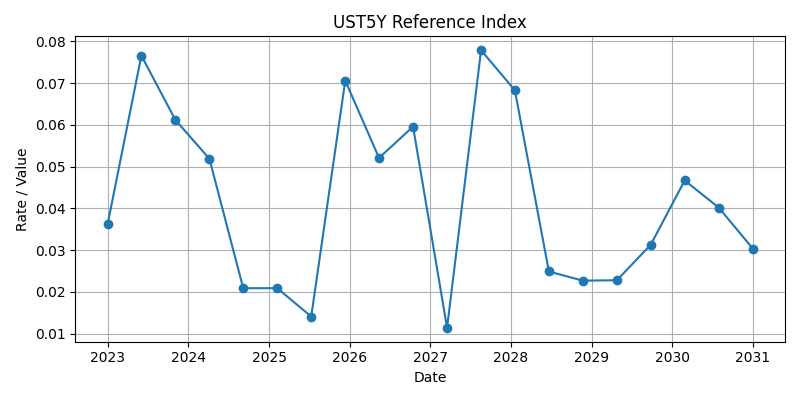

We generate a synthetic interest rate index (UST5Y) with 20 semiannual points from 2023 to 2030.

index_data = pd.DataFrame({

"date": pd.date_range(start="2023-01-01", end="2030-12-31", periods=20).strftime("%Y-%m-%d"),

"value": np.random.uniform(0.01, 0.08, size=20).round(4)

})

ust5y = ReferenceIndex(marketObjectCode="UST5Y", source=index_data, base=1.0)

ust5y.plot()

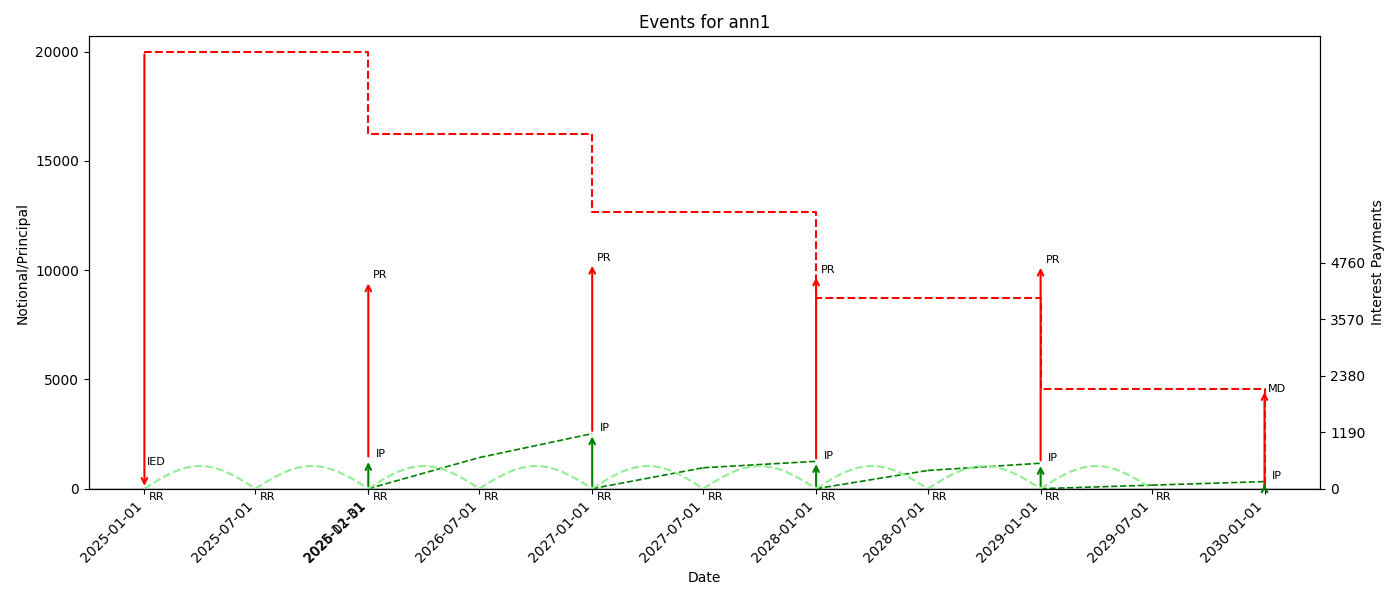

3. Generate Cash Flow Events

Using the contract and index, we generate future cash flow events (principal, interest, etc.).

service = PublicActusService()

events = service.generateEvents(portfolio=ann, riskFactors=ust5y)

events.plot()

Event Table

| type | time | payoff | currency | nominalValue | nominalRate | nominalAccrued | contractId |

|---|---|---|---|---|---|---|---|

| IED | 2025-01-01T00:00 | -20000 | USD | 20000 | 0.04 | 0 | ann1 |

| RR | 2025-01-01T00:00 | 0 | USD | 20000 | 0.0309 | 0 | ann1 |

| PRF | 2025-01-01T00:00 | 0 | USD | 20000 | 0.0309 | 0 | ann1 |

| RR | 2025-07-01T00:00 | 0 | USD | 20000 | 0.0309 | 309 | ann1 |

| PRF | 2025-07-01T00:00 | 0 | USD | 20000 | 0.0309 | 309 | ann1 |

| PRF | 2025-12-31T00:00 | 0 | USD | 20000 | 0.0309 | 616.283 | ann1 |

| PR | 2026-01-01T00:00 | 3760.32 | USD | 16239.7 | 0.0309 | 618 | ann1 |

| IP | 2026-01-01T00:00 | 618 | USD | 16239.7 | 0.0309 | 0 | ann1 |

| RR | 2026-01-01T00:00 | 0 | USD | 16239.7 | 0.0806 | 0 | ann1 |

| PRF | 2026-01-01T00:00 | 0 | USD | 16239.7 | 0.0806 | 0 | ann1 |

| RR | 2026-07-01T00:00 | 0 | USD | 16239.7 | 0.0621 | 654.459 | ann1 |

| PRF | 2026-07-01T00:00 | 0 | USD | 16239.7 | 0.0621 | 654.459 | ann1 |

| PR | 2027-01-01T00:00 | 3591.5 | USD | 12648.2 | 0.0621 | 1158.7 | ann1 |

| IP | 2027-01-01T00:00 | 1158.7 | USD | 12648.2 | 0.0621 | 0 | ann1 |

| RR | 2027-01-01T00:00 | 0 | USD | 12648.2 | 0.0696 | 0 | ann1 |

| PRF | 2027-01-01T00:00 | 0 | USD | 12648.2 | 0.0696 | 0 | ann1 |

| RR | 2027-07-01T00:00 | 0 | USD | 12648.2 | 0.0214 | 440.157 | ann1 |

| PRF | 2027-07-01T00:00 | 0 | USD | 12648.2 | 0.0214 | 440.157 | ann1 |

| PR | 2028-01-01T00:00 | 3926.05 | USD | 8722.12 | 0.0214 | 575.492 | ann1 |

| IP | 2028-01-01T00:00 | 575.492 | USD | 8722.12 | 0.0214 | 0 | ann1 |

| RR | 2028-01-01T00:00 | 0 | USD | 8722.12 | 0.0879 | 0 | ann1 |

| PRF | 2028-01-01T00:00 | 0 | USD | 8722.12 | 0.0879 | 0 | ann1 |

| RR | 2028-07-01T00:00 | 0 | USD | 8722.12 | 0.0349 | 383.337 | ann1 |

| PRF | 2028-07-01T00:00 | 0 | USD | 8722.12 | 0.0349 | 383.337 | ann1 |

| PR | 2029-01-01T00:00 | 4172.68 | USD | 4549.44 | 0.0349 | 535.538 | ann1 |

| IP | 2029-01-01T00:00 | 535.538 | USD | 4549.44 | 0.0349 | 0 | ann1 |

| RR | 2029-01-01T00:00 | 0 | USD | 4549.44 | 0.0327 | 0 | ann1 |

| PRF | 2029-01-01T00:00 | 0 | USD | 4549.44 | 0.0327 | 0 | ann1 |

| RR | 2029-07-01T00:00 | 0 | USD | 4549.44 | 0.0328 | 74.3834 | ann1 |

| PRF | 2029-07-01T00:00 | 0 | USD | 4549.44 | 0.0328 | 74.3834 | ann1 |

| IP | 2030-01-01T00:00 | 148.994 | USD | 4549.44 | 0.0328 | 0 | ann1 |

| MD | 2030-01-01T00:00 | 4549.44 | USD | 0 | 0.0328 | 0 | ann1 |

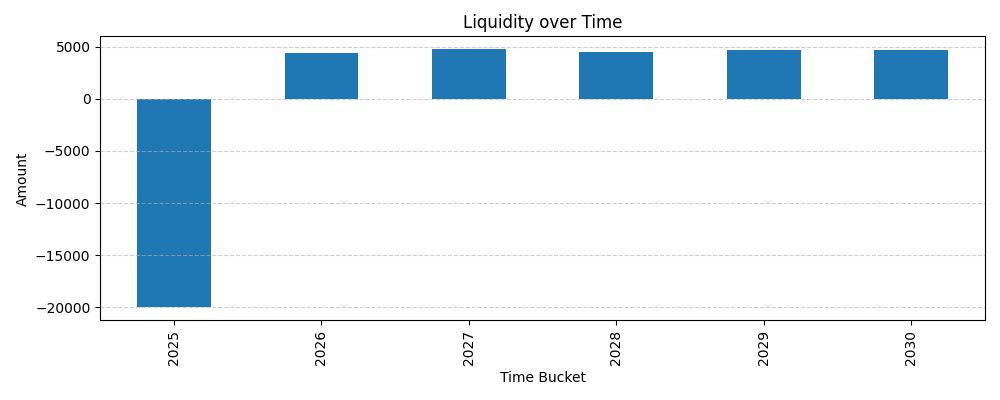

4. Liquidity Analysis

Yearly net cash flows are analyzed to identify funding needs or surpluses.

liq = LiquidityAnalysis(cf_stream=events, freq="Y")

liq.plot()

netLiquidity

time

2025 -20000.000000

2026 4378.319824

2027 4750.203489

2028 4501.546054

2029 4708.218944

2030 4698.437641

5. Value Analysis

Discounted value of future cash flows as of 2025-01-01 using a 2% flat rate.

val = ValueAnalysis(cf_stream=events, as_of_date="2025-01-01", flat_rate=0.02)

as_of_date nominal_value npv

0 2025-01-01 3036.725952 296.344084

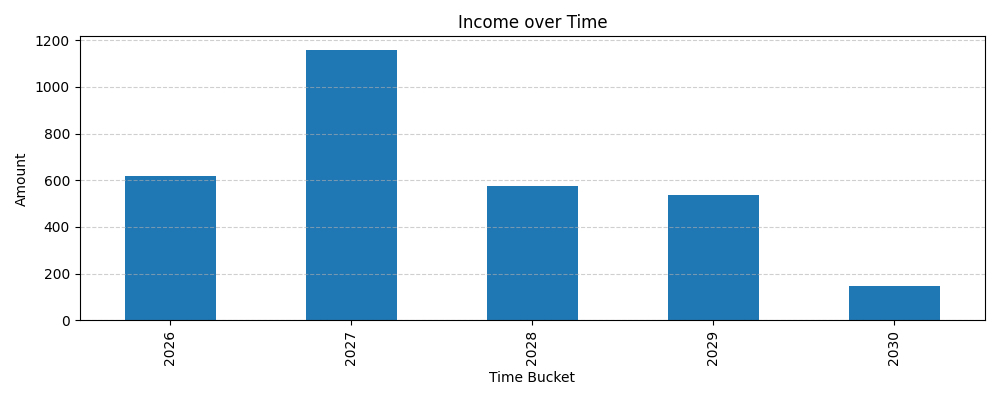

6. Income Analysis

Annual income flows based on the contract’s interest components.

inc = IncomeAnalysis(cf_stream=events, freq="Y")

inc.plot()

netIncome

time

2026 618.000000

2027 1158.701181

2028 575.492093

2029 535.538408

2030 148.994270