Analysis Example: Multi-Contract Portfolio Analysis

This example demonstrates how to model, simulate, and analyze a portfolio of fixed-rate and floating-rate ACTUS contracts using the Awesome Actus Library (AAL).

Step 0: Setup and Imports

We start by importing all required libraries, setting a random seed for reproducibility, and creating a folder to store plots.

import numpy as np

import pandas as pd

from awesome_actus_lib import PAM, ANN, Portfolio, ReferenceIndex, YieldCurve, PublicActusService, LiquidityAnalysis, ValueAnalysis, IncomeAnalysis

np.random.seed(42) # for reproducability

Step 1: Define a Portfolio of Fixed and Floating Contracts

We create a portfolio consisting of:

- 5 fixed-rate Principal-at-Maturity (PAM) contracts

- 3 fixed-rate Annuity (ANN) contracts

- 2 floating-rate Annuity (ANN) contracts linked to a reference index

contracts = []

# Fixed-rate PAM contracts

for i in range(5):

contracts.append(PAM(

contractID=f"pam{i+1}",

contractRole="RPA",

statusDate="2024-12-31",

initialExchangeDate=f"2025-01-0{i+1}",

maturityDate=f"2028-01-0{i+1}",

notionalPrincipal=10000 + i * 1000,

nominalInterestRate=0.02 + i * 0.002,

dayCountConvention="30E360",

currency="USD",

contractDealDate="2024-12-31",

counterpartyID="CP01",

creatorID="Bank01",

cycleOfInterestPayment=["P1YL1","P6ML1","P3ML1","P1YL1","P9ML1"][i],

))

# Fixed-rate ANN contracts

for i in range(3):

contracts.append(ANN(

contractID=f"ann{i+1}",

contractRole="RPA",

statusDate="2024-12-31",

initialExchangeDate=f"2025-02-0{i+1}",

maturityDate=f"2029-02-0{i+1}",

notionalPrincipal=12000 + i * 1500,

nominalInterestRate=0.025 + i * 0.0015,

dayCountConvention="30E360",

cycleOfInterestPayment="P1YL1",

cycleOfPrincipalRedemption="P1YL1",

cycleAnchorDateOfInterestPayment="2026-02-01",

cycleAnchorDateOfPrincipalRedemption="2026-02-01",

currency="USD",

contractDealDate="2024-12-31",

counterpartyID="CP01",

creatorID="Bank01",

))

# Floating-rate ANN contracts

index_code = "US_Floating_6M"

for i in range(2):

contracts.append(ANN(

contractID=f"vann{i+1}",

contractRole="RPA",

statusDate="2024-12-31",

initialExchangeDate=f"2025-03-0{i+1}",

maturityDate=f"2029-03-0{i+1}",

notionalPrincipal=15000 + i * 1000,

nominalInterestRate=0.0, # Overridden by reset

dayCountConvention="30E360",

cycleOfInterestPayment="P1YL1",

cycleOfPrincipalRedemption="P1YL1",

cycleAnchorDateOfInterestPayment="2026-03-01",

cycleAnchorDateOfPrincipalRedemption="2026-03-01",

cycleOfRateReset="P6ML1",

marketObjectCodeOfRateReset=index_code,

rateSpread=0.01,

currency="USD",

contractDealDate="2024-12-31",

counterpartyID="CP02",

creatorID="Bank01",

))

ptf = Portfolio(contracts)

Step 2: Define Risk Factors

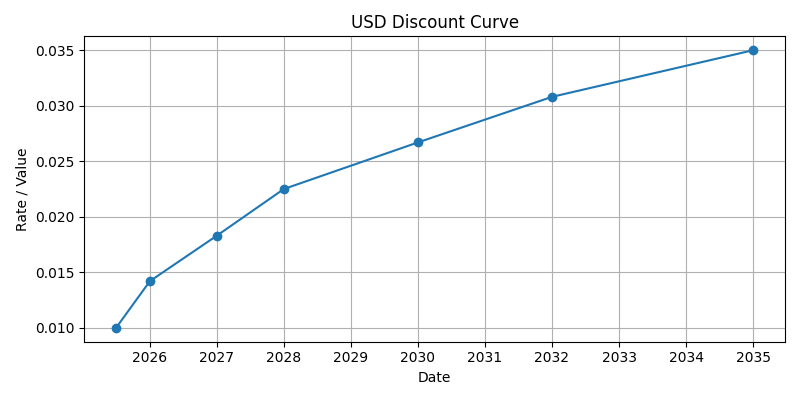

We define a discount curve and a reference index:

- The discount curve is used later for value and income analysis.

- The reference index drives the rate reset of the floating-rate contracts.

Note: We pass both risk factors to generateEvents() even though the discount curve is not used for event generation — this ensures it is included in the resulting CashFlowStream for later analyses. (An alternative would be to inject it into the CashFlowStream manually after generation.)

tenors = ["6M", "1Y", "2Y", "3Y", "5Y", "7Y", "10Y"]

rates = [0.01, 0.015, 0.02, 0.023, 0.028, 0.032, 0.035]

discount_curve = YieldCurve(

marketObjectCode="USD_DISCOUNT",

referenceDate="2025-01-01",

tenors=tenors,

rates=rates,

base=1.0

)

discount_curve.plot()

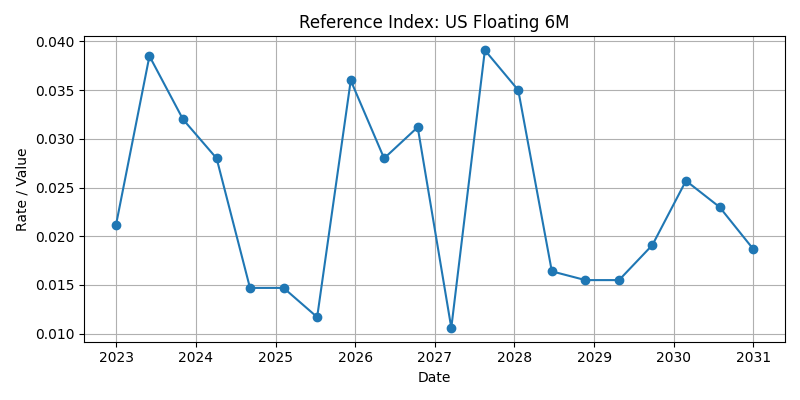

index_data = pd.DataFrame({

"date": pd.date_range(start="2023-01-01", end="2030-12-31", periods=20).strftime("%Y-%m-%d"),

"value": np.random.uniform(0.01, 0.04, size=20).round(4)

})

ref_index = ReferenceIndex(marketObjectCode=index_code, source=index_data, base=1.0)

ref_index.plot()

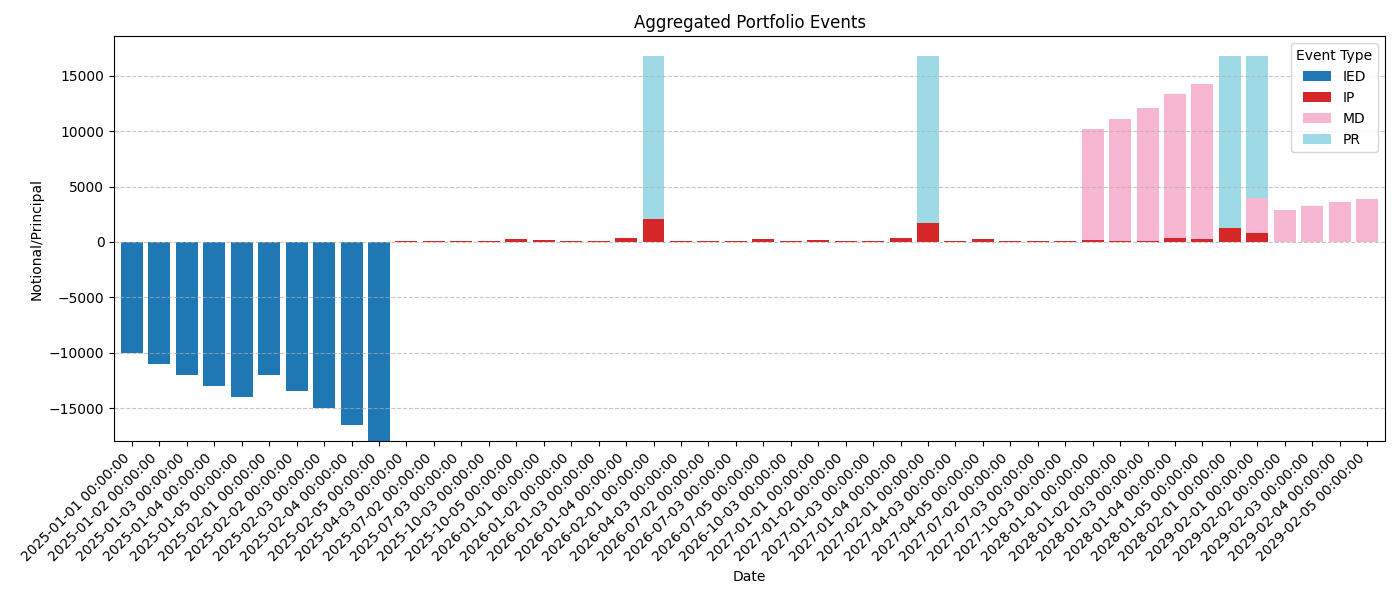

Step 3: Generate Cash Flow Events

We simulate the full event schedule across all contracts:

service = PublicActusService()

events = service.generateEvents(portfolio=ptf, riskFactors=[discount_curve, ref_index])

events.plot()

Preview of Event Table (first 20 rows)

| type | time | payoff | currency | nominalValue | nominalRate | nominalAccrued | contractId |

|---|---|---|---|---|---|---|---|

| IED | 2025-01-01T00:00 | -10000 | USD | 10000 | 0.02 | 0 | pam1 |

| IP | 2025-01-01T00:00 | 0 | USD | 10000 | 0.02 | 0 | pam1 |

| IP | 2026-01-01T00:00 | 200 | USD | 10000 | 0.02 | 0 | pam1 |

| IP | 2027-01-01T00:00 | 200 | USD | 10000 | 0.02 | 0 | pam1 |

| IP | 2028-01-01T00:00 | 200 | USD | 10000 | 0.02 | 0 | pam1 |

| MD | 2028-01-01T00:00 | 10000 | USD | 0 | 0.02 | 0 | pam1 |

| IED | 2025-01-02T00:00 | -11000 | USD | 11000 | 0.022 | 0 | pam2 |

| IP | 2025-01-02T00:00 | 0 | USD | 11000 | 0.022 | 0 | pam2 |

| IP | 2025-07-02T00:00 | 121 | USD | 11000 | 0.022 | 0 | pam2 |

| IP | 2026-01-02T00:00 | 121 | USD | 11000 | 0.022 | 0 | pam2 |

| IP | 2026-07-02T00:00 | 121 | USD | 11000 | 0.022 | 0 | pam2 |

| IP | 2027-01-02T00:00 | 121 | USD | 11000 | 0.022 | 0 | pam2 |

| IP | 2027-07-02T00:00 | 121 | USD | 11000 | 0.022 | 0 | pam2 |

| IP | 2028-01-02T00:00 | 121 | USD | 11000 | 0.022 | 0 | pam2 |

| MD | 2028-01-02T00:00 | 11000 | USD | 0 | 0.022 | 0 | pam2 |

| IED | 2025-01-03T00:00 | -12000 | USD | 12000 | 0.024 | 0 | pam3 |

| IP | 2025-01-03T00:00 | 0 | USD | 12000 | 0.024 | 0 | pam3 |

| IP | 2025-04-03T00:00 | 72 | USD | 12000 | 0.024 | 0 | pam3 |

| IP | 2025-07-03T00:00 | 72 | USD | 12000 | 0.024 | 0 | pam3 |

| IP | 2025-10-03T00:00 | 72 | USD | 12000 | 0.024 | 0 | pam3 |

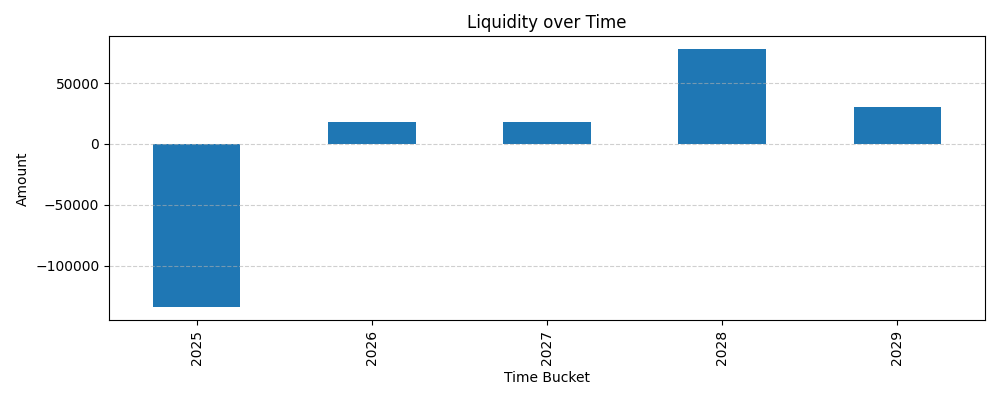

Step 4: Liquidity Analysis

This shows net inflows and outflows aggregated per year. It is useful to assess funding needs or surpluses.

liq = LiquidityAnalysis(cf_stream=events, freq="Y")

liq.plot()

netLiquidity

time

2025 -130869.000000

2026 18057.974013

2027 18335.536044

2028 78097.645896

2029 26657.859228

Step 5: Value Analysis

We discount all future cash flows using the yield curve to compute present value as of 2025-01-01.

val = ValueAnalysis(cf_stream=events, as_of_date="2025-01-01", discount_curve_code="USD_DISCOUNT")

as_of_date nominal_value npv

0 2025-01-01 10280.015181 1306.439457

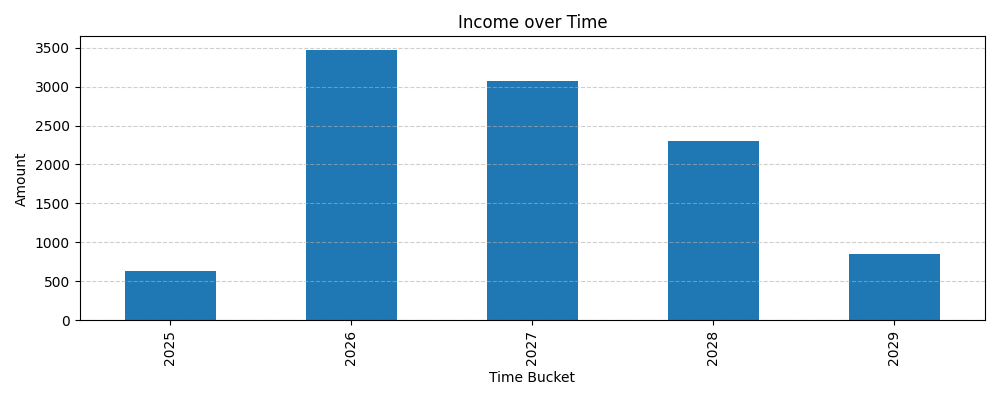

Step 6: Income Analysis

This breaks down recognized income over time, based on the contractual cash flows.

inc = IncomeAnalysis(cf_stream=events, freq="Y")

inc.plot()

netIncome

time

2025 631.000000

2026 3154.658472

2027 3243.326902

2028 2460.038044

2029 790.991763