Simulating Value-at-Risk (VaR) for a Single PAM Contract

This example illustrates how to simulate multiple interest rate scenarios and evaluate the Value-at-Risk (VaR) of a fixed-rate ACTUS PAM contract using the Awesome Actus Library (AAL).

Disclaimer: This is a simplified, stylized example for educational purposes. It demonstrates simulation methodology and risk analysis but does not reflect actual market behavior or pricing standards.

Step 0: Setup and imports

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from awesome_actus_lib import PAM, PublicActusService, ValueAnalysis, ReferenceIndex, YieldCurve

np.random.seed(42)

Step 1: Define the Contract

We define a single fixed-rate Principal-at-Maturity (PAM) contract with annual interest payments and maturity in 2029.

contract = PAM(

contractID="PAM-01",

statusDate="2025-12-30",

contractDealDate="2023-12-31",

currency="USD",

notionalPrincipal=10000,

initialExchangeDate="2024-01-01",

maturityDate="2029-12-31",

nominalInterestRate=0.05,

cycleAnchorDateOfInterestPayment="2024-01-01",

cycleOfInterestPayment="P1YL0",

dayCountConvention="30E360",

endOfMonthConvention="SD",

premiumDiscountAtIED=0,

contractRole="RPA",

creatorID="Bank-01",

counterpartyID="Counterparty-01",

marketObjectCodeOfRateReset="IR_SCENARIO",

rateSpread=0,

cycleOfRateReset="P1YL0",

cycleAnchorDateOfRateReset="2024-01-01",

)

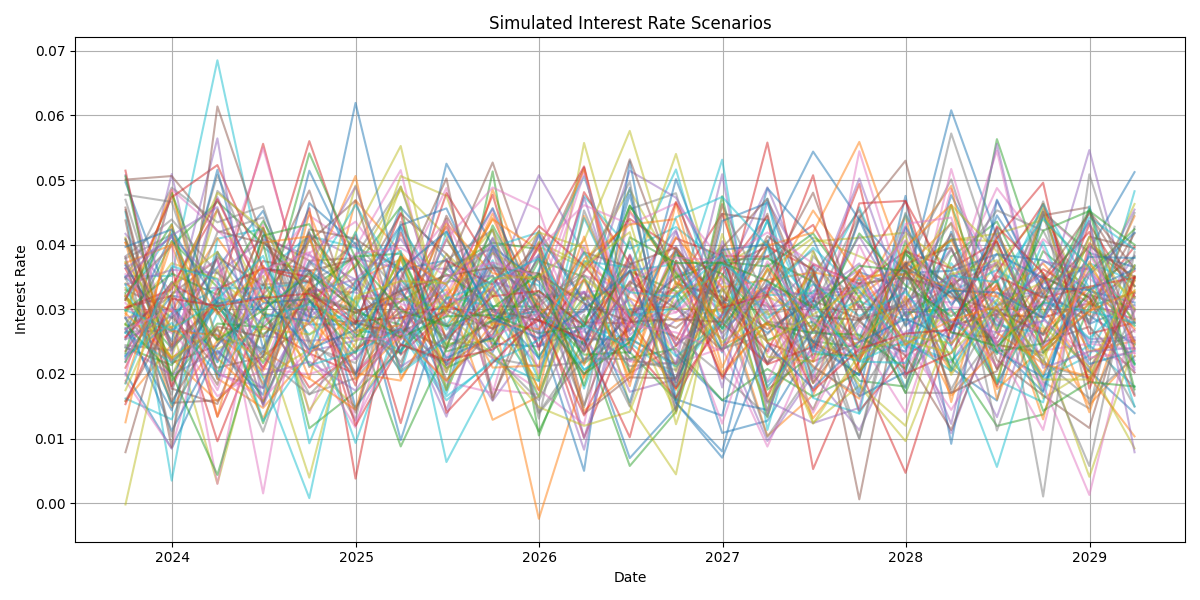

Step 2: Simulate Interest Rate Scenarios

We simulate 100 interest rate paths using a normal distribution centered at 3% with 1% volatility.

n_scenarios = 100

scenarios = []

date_range = pd.date_range(start="2023-09-01", periods=23, freq="Q")

for _ in range(n_scenarios):

simulated_rates = np.random.normal(loc=0.03, scale=0.01, size=len(date_range))

df = pd.DataFrame({"date": date_range, "value": simulated_rates})

scenario = ReferenceIndex(marketObjectCode="IR_SCENARIO", source=df, base=1.0)

scenarios.append(scenario)

# Plot interest rate scenarios

plt.figure(figsize=(12, 6))

for scenario in scenarios:

df = scenario._data.copy()

plt.plot(pd.to_datetime(df["date"]), df["value"], alpha=0.5)

plt.title("Simulated Interest Rate Scenarios")

plt.xlabel("Date")

plt.ylabel("Interest Rate")

plt.grid(True)

plt.tight_layout()

plt.show()

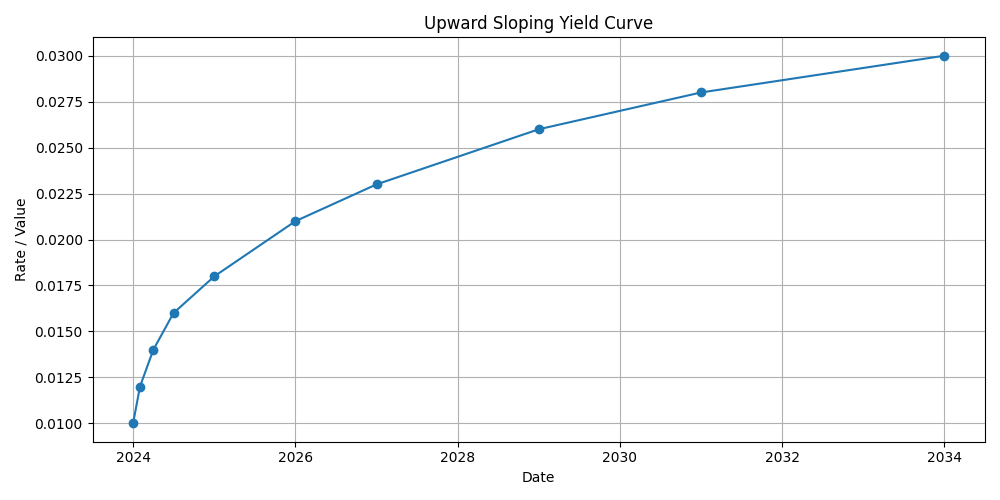

Step 3: Define the Yield Curve

The discounting is done using a upward-sloping yield curve.

yield_curve = YieldCurve(

marketObjectCode="DC_YC",

referenceDate="2024-01-01",

tenors=["0D", "1M", "3M", "6M", "1Y", "2Y", "3Y", "5Y", "7Y", "10Y"],

rates=[0.01, 0.012, 0.014, 0.016, 0.018, 0.021, 0.023, 0.026, 0.028, 0.03]

)

yield_curve.plot()

Step 4: Run Simulations and Compute NPVs

service = PublicActusService()

npvs = []

for scen in scenarios:

events = service.generateEvents(portfolio=contract, riskFactors=[scen, yield_curve])

val = ValueAnalysis(events, as_of_date="2026-01-01", discount_curve_code="DC_YC")

npvs.append(val.npv)

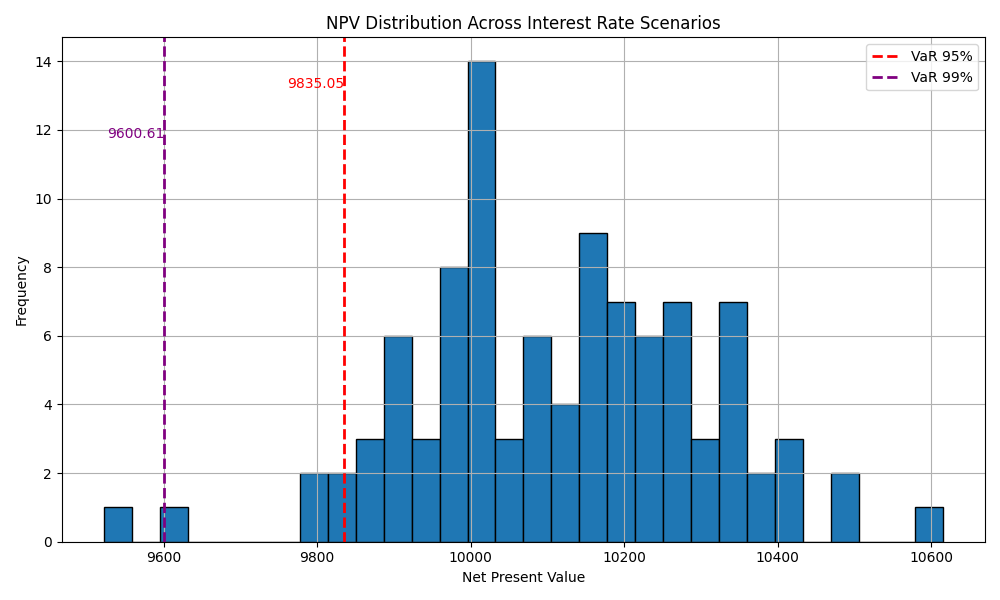

Step 5: Plot NPV Distribution and Calculate Risk Measures

var_95 = np.quantile(npvs, 0.05)

var_99 = np.quantile(npvs, 0.01)

initial = contract.terms.get("notionalPrincipal").value

breakeven_prob = sum(npv >= initial for npv in npvs) / len(npvs)

plt.figure(figsize=(10, 6))

plt.hist(npvs, bins=30, edgecolor="black")

plt.axvline(var_95, color='red', linestyle='--', linewidth=2, label='VaR 95%')

plt.axvline(var_99, color='purple', linestyle='--', linewidth=2, label='VaR 99%')

plt.text(var_95, plt.ylim()[1]*0.9, f'9835.05', color='red', ha='right')

plt.text(var_99, plt.ylim()[1]*0.8, f'9600.61', color='purple', ha='right')

plt.title("NPV Distribution Across Interest Rate Scenarios")

plt.xlabel("Net Present Value")

plt.ylabel("Frequency")

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

print(f"VaR 95%: {var_95}")

print(f"VaR 99%: {var_95}")

print(f"Break-even Probability (NPV ≥ 10000): {breakeven_prob}%")

Results:

- VaR 95%: 9835.05

- VaR 99%: 9600.61

- Break-even Probability (NPV ≥ 10000): 70.00%