Core Concepts of ACTUS

The ACTUS Standard is built around a set of core concepts that define how financial contracts are represented, interpreted, and simulated. These concepts are designed to ensure clarity, consistency, and automation in modeling financial instruments.

1. Contract Types (CTs)

Contract Types define the behavioral logic of financial contracts in terms of their cash flow patterns. A CT determines how payments such as interest, fees, and principal evolve over time based on given inputs.

The defining characteristic of a contract type is not its legal or market label, but its cash flow generation logic. This means that a wide variety of financial contracts—despite different names or purposes—can be represented using the same ACTUS contract type if they share the same underlying cash flow structure.

Example:

- A bullet loan, a term deposit, and a bond can all be modeled using the PAM (Principal at Maturity) contract type, since they all involve a single principal repayment at maturity with periodic interest payments.

Common CTs include:

- PAM – Principal at Maturity

- ANN – Annuity

- LAM – Linear Amortizer

- SWPPV – Plain Vanilla Swap

- FXOUT – Foreign Exchange Outright

- OPTNS – Options

Each CT provides a clear and formal definition of how cash flows are generated, making it a building block for automated and consistent financial modeling.

2. Contract Terms / Contract Attributes (CAs)

Contract Attributes define the parameters needed to instantiate a specific contract. These include values like interest rate, notional principal, maturity date, and frequency of payments.

Attributes can be:

- Mandatory: Must be defined for a valid contract.

- Optional: May be omitted, with defaults or implied logic applied.

- Not Applicable: Irrelevant for a specific contract type.

ACTUS includes a dictionary of all attributes and their properties (type, domain, default, applicability) see: ACTUS Data Dictionary.

2.1 Applicability Rules (Business Rules)

To enforce this logic, ACTUS defines business rules that govern the applicability of each attribute for a certain contract type. These rules are expressed in a compact syntax:

a(b,c,d)e

Where:

a: Whether the attribute is mandatory (NN), optional (x), or not applicable ([]).b: Group number for logically related attributes.c: Dependency logic within the group (e.g., driver-dependent).d: Applicability to parent or child contract contexts.e: Special rules for specific contract logic (e.g., synchronizations or exceptions).

These rules dynamically determine which attributes are required or relevant depending on the contract type, the structure of the contract (e.g., parent/child relationships), and the values of other attributes.

🔎 To correctly configure a contract, it's essential to consult the detailed documentation for the specific contract type.

In the Contract Types Reference, each CT is described along with:

- The list of applicable attributes

- Their corresponding business rules

- Special logic or dependencies

This ensures you only set the required and relevant terms when modeling contracts using ACTUS.

3. Risk Factors

Risk factors represent external economic variables that influence the cash flows of a financial contract. These include elements such as:

- Interest rates

- Market indexes

- FX rates

- Commodity prices

- Inflation rates

While contract terms define the static structure of a contract, risk factors introduce dynamic behavior based on economic conditions. They are not part of the contract itself but serve as external inputs during simulation.

How Risk Factors Are Referenced

Within ACTUS, risk factors are linked to specific contract attributes through references using the marketObjectCode. This ensures clear mapping between a contract and the economic variable it depends on.

For example:

- A floating interest rate contract may use

marketObjectCodeOfRateResetto reference a risk factor like LIBOR or EURIBOR. - A scaling index or a rate spread can be tied to external market values through similar references.

Risk factors are modeled as time series or scenario-based data, enabling simulation of future contract behavior under various assumptions.

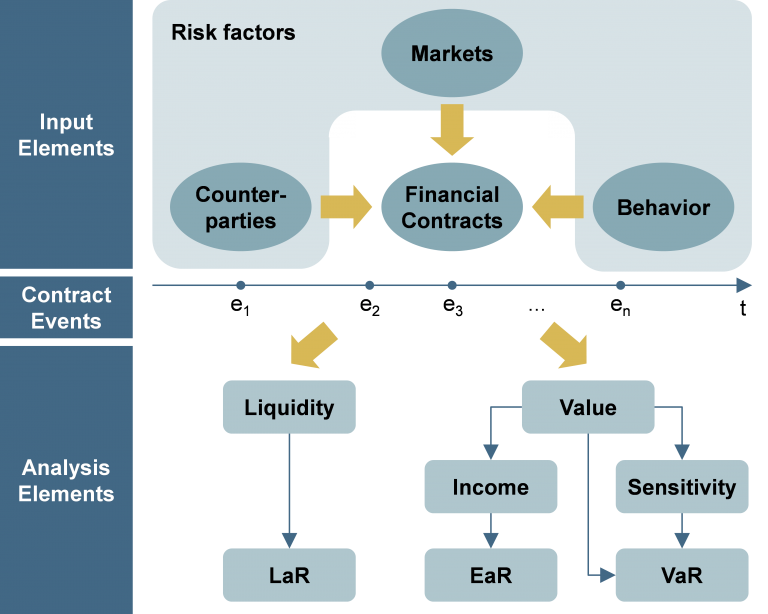

4. Modeling Methodology

ACTUS employs a deterministic and stateful modeling paradigm to simulate financial contracts and generate analytically useful outputs.

At the heart of this paradigm is a strict separation of concerns:

- Contract Terms: These are static. Once a contract is agreed, its legal definition does not change.

- Risk Factors: These are dynamic. They evolve over time and represent changing macroeconomic, market, and behavioral conditions.

This clean separation enables reliable contract simulation while supporting dynamic scenario analysis and stress testing.

How It Works

-

Input Elements:

- Contract terms (structure and logic)

- Risk factor paths (e.g. interest rates, FX rates)

- Behavior and counterparty characteristics

-

Simulation:

- ACTUS simulates time-based contract events (e.g. interest payments, redemptions).

- Events update internal state (e.g. remaining principal, accrued interest).

- Result is a cash flow stream: a sequence of timestamped financial events.

-

Analysis:

- The generated event stream forms the basis for calculating metrics such as:

- Liquidity at Risk (LaR)

- Earnings at Risk (EaR)

- Value at Risk (VaR)

- Contractual valuation, sensitivity, and income

- Because these outputs derive directly from discrete events, they are auditable and transparent.

- This event-centric design allows drill-down to individual flows, enhancing explainability.

- The generated event stream forms the basis for calculating metrics such as:

ACTUS Modeling Paradigm

Figure: ACTUS separates the known (contract structure) from the unknown (future risk factor paths). Events are simulated deterministically, and metrics are derived by aggregating these events.

To explore details of specific contract types or attributes, continue to: