Architecture

The Awesome ACTUS Library is built on a clear design principle:

➡️ Make ACTUS-compliant contract modeling intuitive, extensible, and user-friendly.

To achieve this, the library adopts a Model-View-Controller (MVC) design pattern — applied to a financial modeling context.

🧠 Design Pattern: Model-View-Controller (MVC)

🧩 Model — Contract Definitions & Financial Data Structures

This layer represents the core ACTUS domain and acts as both the input and output interface of the library.

It includes:

-

✅ ACTUS Contract Types (CTs)

Defined through classes likePAM,ANN, each of which inherits from the abstractContractModel. Each contract holds a list ofContractTermobjects representing individual data fields (e.g.,NotionalPrincipal,MaturityDate, etc.). -

✅ Risk Factors

Modeled as time-value series. All risk factors inherit from the abstract classRiskFactor, with concrete implementations such as:ReferenceIndexYieldCurve

-

✅ Simulation Output:

CashFlowStream

Encapsulates the cash flow events returned from the simulation engine. Provides a tabular representation of results and file I/O utilities. -

✅ Portfolio

A structured collection of contract instances (ContractModel), allowing grouped simulation and aggregation.

The model layer prepares the inputs for the controller, and structures the outputs received back from the simulation engine.

It is:

- 💡 Declarative

- 📦 Serializable (e.g., to JSON)

- 🧪 Testable without backend services

🛠️ Controller — Backend Service Interfaces

This layer orchestrates the interaction with external ACTUS-compliant computation engines:

ActusService: Manages contract simulation requests and returnsCashFlowStreamresults. Supports both local (e.g., Docker) and remote servers.RiskService: Uploads and configures risk factor time series for scenario-driven simulations.PublicActusService: A lightweight subclass ofActusServicewith preconfigured settings for quick demos and easy onboarding.

Controllers:

- Validate and serialize model data

- Handle server communication

- Maintain separation between business logic and backend implementation

All controller classes follow a common pattern and abstract base interface for extensibility.

📊 View — Analysis Layer

This layer takes the CashFlowStream as input and transforms it into meaningful financial insights.

It includes:

IncomeAnalysis: Computes net inflows/outflows by event type or direction.LiquidityAnalysis: Tracks cash balance over time, useful for liquidity stress testing.ValueAnalysis: Applies time discounting to compute Net Present Value (NPV) or other value metrics.

Although there’s no frontend UI, this analysis layer fulfills the role of a “view” by organizing simulation output for presentation and reporting.

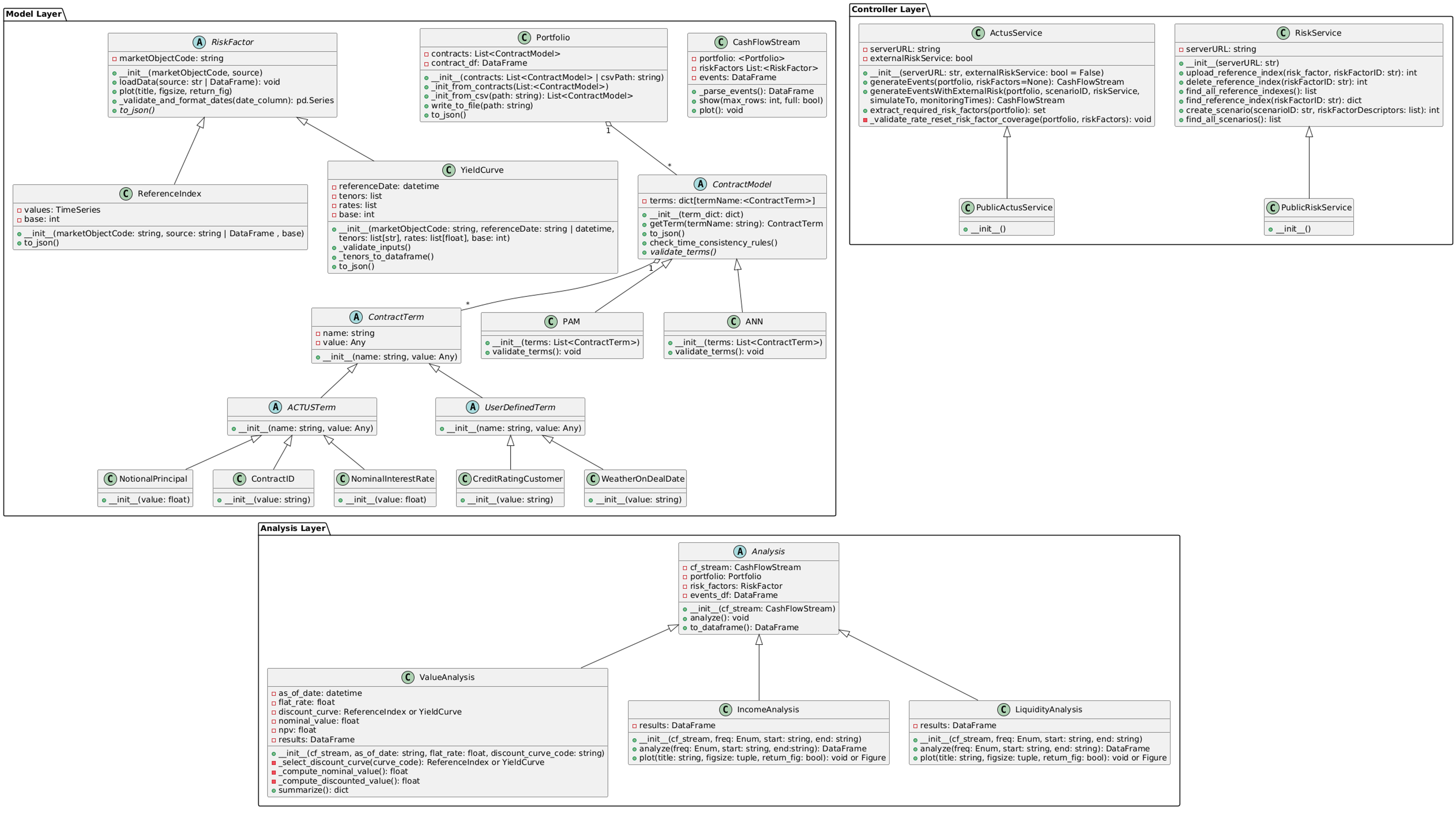

🖼️ Class Diagram

The image below shows the full structure of the library's architecture, grouped by MVC layer and organized according to inheritance and composition:

This class diagram is kept in sync with the library's source code and should serve as a reference when contributing, extending, or integrating.

🔌 Abstraction & Extensibility

The library makes extensive use of abstract base classes to ensure clean interfaces and modular extension:

| Abstract Class | Role |

|---|---|

ContractModel | Blueprint for ACTUS ContractTypes |

ContractTerm | Represents a typed input field as name - value pair |

ACTUSTerm | ACTUS contract term |

RiskFactor | Base class for all time series risk inputs |

Analysis | Base class for all post-simulation analytics |

ActusService | Extensible controller for backend simulation |

This structure allows users to:

- Plug in their own backend engines or risk sources

- Add new types of financial analyses

🔁 Data & Control Flow

1. User defines contract:

pam = PAM([NotionalPrincipal(...), MaturityDate(...), ...])

2. (Optional) User defines risk factors:

ref_index = ReferenceIndex(...)

3. User sends contracts and risk factors to the backend:

actus_service = PublicActusService()

actus_service.generateEvents(pam, ref_index)

4. The backend returns a CashFlowStream:

event_stream = actus_service.generateEvents(pam, ref_index)

5. User passes output into analysis modules:

liquidity = LiquidityAnalysis(event_stream)